Many of us would not doubt the importance of education. We begin our educational journey as early as three or four years old in pre-school and stay in school until we graduate high school at seventeen or eighteen.

Many of us choose to continue after high school in trade schools, college, military, and possibly even graduate school. Adults seek continuing education, employers offer training, and online courses have increased steadily over the last several years.

The evidence of the importance of education is abundant. Let’s face it. We like to improve our knowledge of a wide variety of topics. Money is one of those topics. Why, money? Well, the fact we begin using it early in life and use it until the day we die, make a strong case you having a solid foundation of money knowledge.

Reading books is one of those ways we can increase knowledge. The fact that there are over 9000 public libraries in the United States makes a solid case for the popularity of this medium.

Here are nine of the best-selling personal finance books. Learn how to catapult yourself to success and better manage your money, and maybe even teach the kids to a thing or two before they begin their financial lives.

With a robust financial IQ, you can have even more free time in the future to unwind and enjoy peace of mind, knowing you have your finances in order.

Lifelong Learning

Are you a lifelong learner? Lifelong learning is the “ongoing, voluntary, and self-motivated” pursuit of knowledge for either personal or professional reasons. Lifelong learning enhances not only social inclusion, active citizenship, and personal development, but also self-sustainability, as well as competitiveness and employability.

Lifelong learning is another illustration of the importance of education.

Importance of Education: Our Favorite Money Books

In no particular order, here are nine of our favorite books on money.

A Total Money Makeover by Dave Ramsey

Okay, folks, do you want to turn those big and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. Dave uses his common sense of baby steps and real-life stories to teach you all about your money.

The Millionaire Next Door by Thomas J. Stanley

The bestselling The Millionaire Next Door identifies seven common traits that show up again and again among those who have accumulated wealth. Most of the truly wealthy in this country don’t live in Beverly Hills or on Park Avenue-they live next door.

One Page Financial Plan by Carl Richard

The most important thing is getting clarity about the big picture so you can cope with the unexpected. Maybe you’ll lose the job you thought was secure; you’ll take a financial risk that doesn’t pan out; you’ll have twins when you were only budgeting for one. In other words: Life will happen.

But no matter what happens, this book will help you bridge the gap between where you are now and where you want to go.

Your Money or Your Life by Vicki Robin and Joe Dominquez

In an age of high economic uncertainty when everyone is concerned about money and how they spend what they have, Your Money or Your Life is an essential read. The book focuses on the premise that we exchange our time for money. And when you start thinking about how many hours of your life it took to save up the money to buy something, you start thinking twice about your purchases.

The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich by David Bach

The Automatic Millionaire tells a compelling story of an average American couple, whose joint income never exceeds $55,000 a year, yet who somehow manage to own two homes debt-free, put two kids through college, and retire at 55 with more than $1 million in savings. Through their story, you’ll learn the surprising fact that you cannot get rich with a budget! You have to have a plan to pay yourself first that is automatic, a plan that will automatically secure your future and pay for your present.

I Will Teach You to Be Rich by Ramit Sethi

At last, for a generation that’s materially ambitious yet financially clueless comes I Will Teach You To Be Rich, Ramit Sethi’s 6-week personal finance program for 20-to-35-year-olds. An efficient approach delivered with a nonjudgmental style that makes readers want to do what Sethi says, it is based on the four pillars of personal finance— banking, saving, budgeting, and investing—and the wealth-building ideas of personal entrepreneurship.

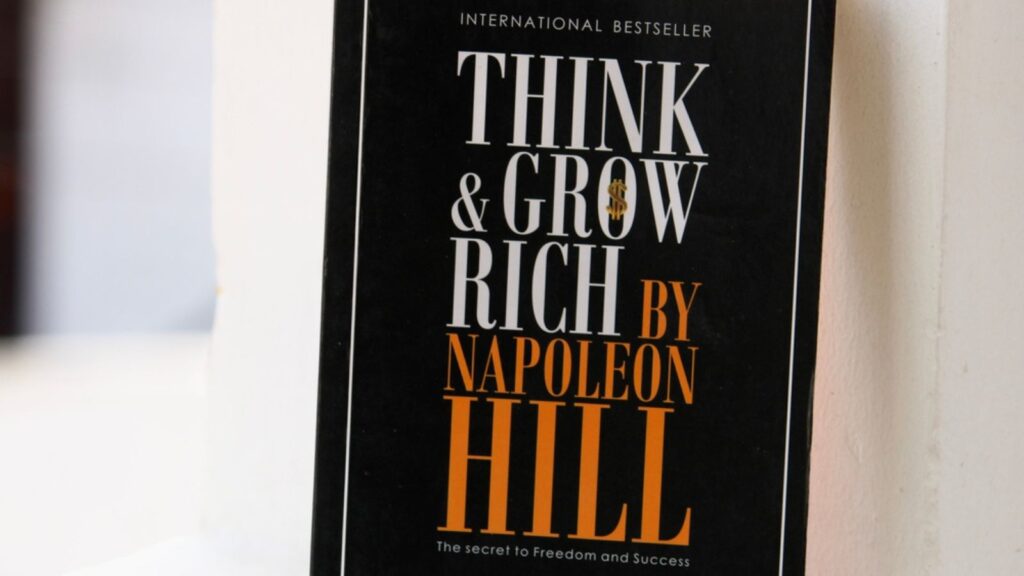

Think and Grow Rich by Napoleon Hill

In Think and Grow Rich, Hill draws on stories of Andrew Carnegie, Thomas Edison, Henry Ford, and other millionaires of his generation to illustrate his principles. This book will teach you the secrets that could bring you a fortune. It will show you not only what to do but how to do it. Once you learn and apply the simple, basic techniques revealed here, you will have mastered the secret of real and lasting success.

Money and material things are essential for freedom of body and mind. Still, there are some who will feel that the greatest of all riches can be evaluated only in terms of lasting friendships, loving family relationships, understanding between business associates, and introspective harmony which brings one true peace of mind!

The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns by John C. Bogle

John C. Bogle, the founder of the Vanguard Group and creator of the world’s first index mutual fund—has relied primarily on index investing to help Vanguard’s clients build substantial wealth. Now, with The Little Book of Common Sense Investing, he wants to help you do the same.

It is filled with in-depth insights and practical advice. The Little Book of Common Sense Investing will show you how to incorporate this proven investment strategy into your portfolio. It will also change the very way you think about investing. Successful investing is not easy. (It requires discipline and patience.) But it is simple. For it’s all about common sense.

Smart Money Smart Kids: Raising the Next Generation to Win With Money by Rachel Cruz

In Smart Money Smart Kids, financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze equip parents to teach their children how to win with money. They start with the basics like working, spending, saving, and giving. Then moving into more challenging issues like avoiding debt for life, paying cash for college, and battling discontentment, Dave and Rachel present a no-nonsense, common-sense approach for changing your family tree and increase your kid’s financial IQ.

Summary

We hope you’ve found this list useful. There are many excellent books on money management, investing, paying off debt, etc. The great news is that many can be found at your local library. If you find the subject matter isn’t right for you, return it and check out another.

We recommend once you find a book you enjoy and learn something from considering purchasing it. This way, you can highlight some of the critical points, and refer back to it when you need a refresher.

Reading one or many of these finance books will be like meeting with a financial advisor for financial advice without the cost. These books will teach you about debt management, saving for retirement, saving money, paying off credit cards, increase your credit score, and reaching your financial goals. Think of how much wealth you could have built if you read any of these books as a young adult. The good news is, it’s never too late to start. Happy reading!