A budget is the first step in becoming organized with your money. It’s the key to understanding how much you have coming in and how much you have going out each month. There are many ways to document and organize a budget. You can track it via paper, a spreadsheet, software or app. You need to choose a way that works best for you. Once you have your format of choice here are the basics for a killer budget.

Budget Basics 101

A budget is a record of your income and expense. How do you define income and expense? Well it may vary for individuals, but generally, they are:

Income – Money you earn each day week, month, etc.

Expenses – Mortgage, rent, food, gas, cable, insurance, phone, electric, student loans, credit cards, medical, alarm, pet care, etc.

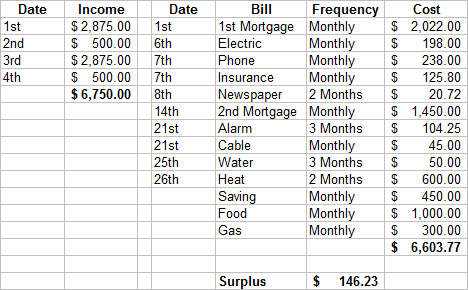

The simplest way to understand these numbers are to grab your statements for all income and expenses and begin to organize them. Here is an example of a budget:

The income shows four payments, one during each week of the month. For added detail, on all expenses or bills, I capture the date it is due and the frequency that it occurs. Some bills are paid monthly and others quarterly, etc. This can help you stay even more on top of expenses. This budget is balanced as the income is greater than the expenses and in fact, there is a surplus at the end of the month. I would not expect all budgets to look like this when first starting. Not having a plan for your money typically leads to overspending and a need for a budget.

Also when first capturing a budget it often has leaks, those unconscious spending habits on the little everyday things that add up over time. Often referred to as the “latte factor”, how I suggest you understand what your latte factors are, is to track your spending habits for two to three months. Saving all receipts and compiling a list. You will be surprised how much that daily Starbucks coffee is impacting your budget or how fast those convenient takeout meals can add up.

Once you do that you will have a complete picture of your income and expenses. Then depending on your goals, you can begin to build a plan. Do you need to cut expenses, well they are all down on paper now, and you can begin to prioritize them. Do you need to make more income, or maybe it’s a combination of both? The combination of cutting expenses and earning more is a powerful way to achieve your goals even faster.

Budget with Debt

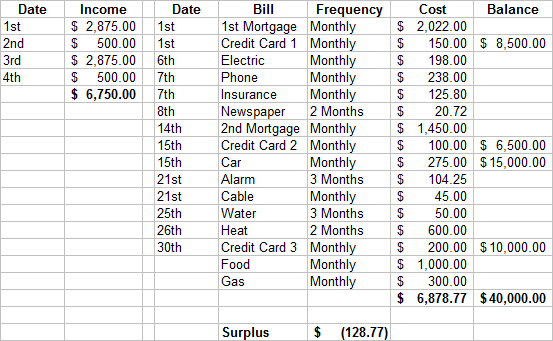

Now let’s take at a budget with a little more debt.

Now this budget has the same income as our first example, but four additional expenses, three credit cards, and a car payment leaving it at a deficit of $128.77 per month. This is a problem that needs to be addressed by cutting expenses or adding income immediately. Leaving the deficit can lead to continuing to use debt to cover expenses and compiling a bigger pile of debt.

Just like in example one tracking expenses for a period of time will give you an idea of what expense can be prioritized and cut back to free up money. After all, cuts are made if there is still a deficit, more income will need to be earned.

You need to stop adding new debt to the total to be successful in getting out of debt.

Debt Snowball

The Debt Snowball is a key tool in eliminating debt. The debt snowball is named after a snowball and the thought of one rolling downhill and gaining momentum. Using the debt snowball technique to pay off your debt does just that it helps you build and keep momentum.

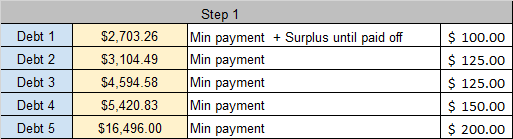

Let’stake a close up look at a debt example. I have sorted the debts from lowest to highest balance. This is the basic principle behind the debt snowball, you attacked the debt with the lowest balance first until it’s gone. This helps build momentum. You still continue to make minimum payments on all other debts. Any extra money you have gets applied to payments for your lowest debt. Once that is paid off you move on to the next lowest balance debt.

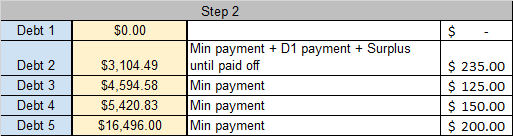

So let’s assume we’ve paid off debt #1. The next debt to attack would be debt #2. To keep the momentum going, we take the payment we were sending to debt #1 and apply it to debt #2. As you can see our payment for debt #2 increase from the example given above from $125 to the example given below to $235, the $110 difference is the $110 we used to send to debt #1, ($100 minimum payment and $10 surplus) but with that now paid in full we have the extra cash to put towards debt #2.

The one thing that is not captured is since you are still making minimum payments on all debts, each balance will be decreasing. That is not reflected in my examples.

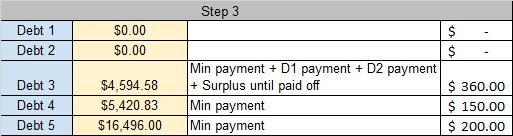

Moving on let’s assume you have now paid off debt #2, you would follow the same steps as you did in the example given above applying debt #2’s payment to debt #3. As you can see in the example given below the payment jumped from $125 to $360.

That is the basic concept behind the debt snowball. You continue to roll payments over once a debt is paid off to the next until all debt is paid. Any cutback in spending and additional income you can add along the way to increase the payment will speed up the time that you can pay off your debt.

One trick to help keep the momentum going and build some anticipation for the milestone of paying off a debt is once a debt is paid off, and before you roll the payment over to your next lowest debt it to use the money for a purchase, dinner out, some new clothes, house repairs, etc. The road to paying off debt can be long and difficult you need to find what works best for you to keep you motivated and on track to complete the debt repayment in full.

I realize this is a lot of information for someone looking at it for the first time so please do not hesitate to contact me with any questions. Good luck getting organized with your budget and paying off your debt!